Post-secondary access

Sixty per cent of post-secondary students in Canada come from the richest 40 percent of families while only 27 per cent of students come from the 40 percent of families with the lowest incomes. Canada's performance in university educational attainment ranks 18th out of 34 OECD countries.

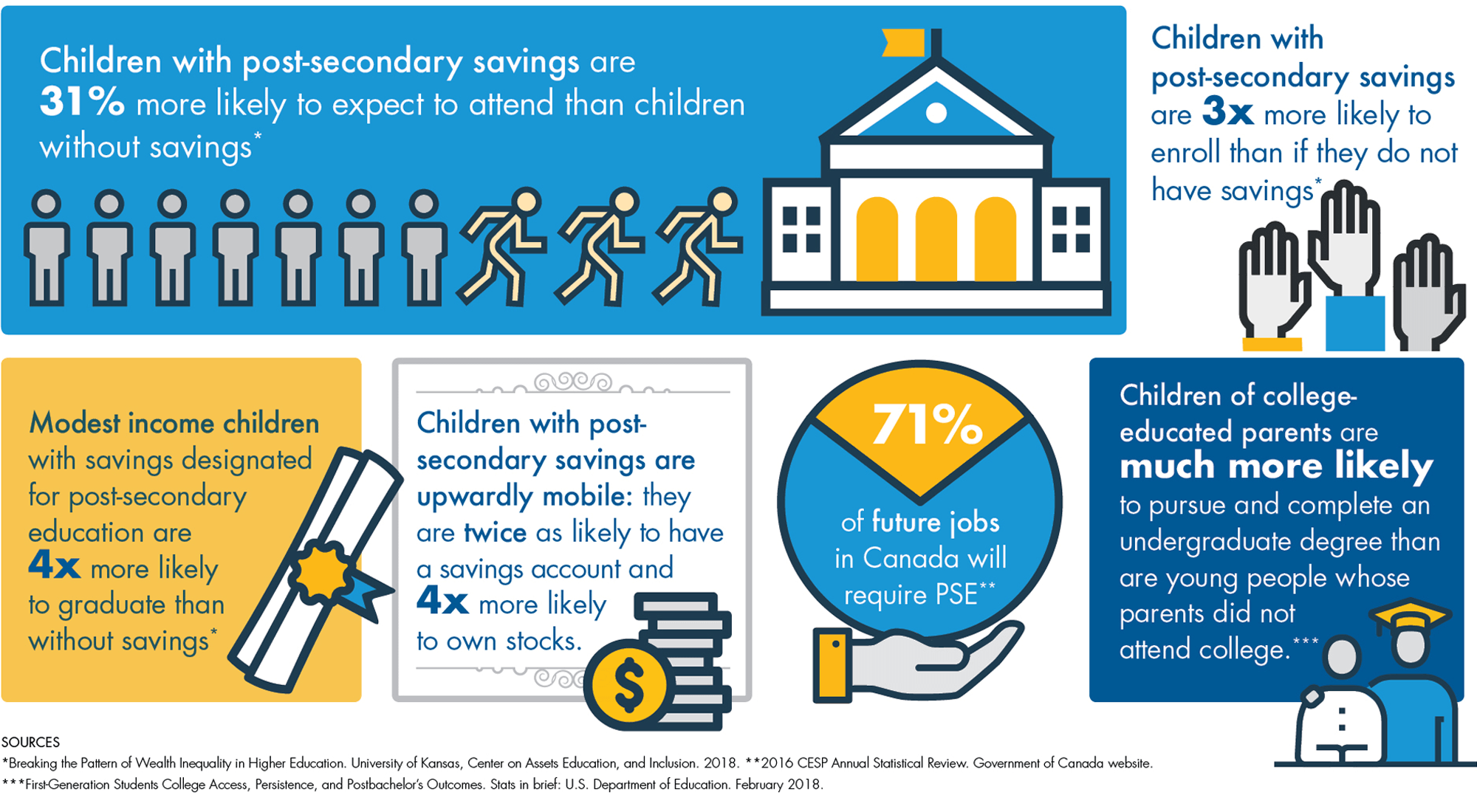

In 2016, SmartSAVER commissioned research from Dr. Andrew Parkin about the connection between educational savings and access to post-secondary institutions. His findings strengthened our resolve to ensure that more modest-income Canadian families achieve the financial savings necessary to make post-secondary education a reality for their children.

Report highlights

“Some U.S. researchers suggest that the accumulation of savings for a child’s post-secondary education can affect a child’s identity by helping to form and reinforce a specifically ‘college-bound identity’ (see, for instance, Elliott, Destin and Friedline, 2011). This identity is informed by the sense that college is relevant (children see it as part of their future), is consistent with a larger group or family identity (children see that they belong to a group that attends college), and is an option that will not be deterred by difficulties (children see that they have the ability to overcome obstacles to college) (Elliott, Destin and Friedline, 2011, 8-9)."

“Evidence of a different type – and concerning much older children – comes from the study of the impact of the Learning Accounts that were tested as part of the Future to Discover experiment in New Brunswick. Above, it was seen that the early promise of PSE funding provided through the Learning Accounts improved education outcomes (enrolment and graduation). In the context of this discussion of attitudes and behaviours, we can add that the offer of Learning Accounts was also seen to have a modest impact on academic performance while the students were still in high school.”

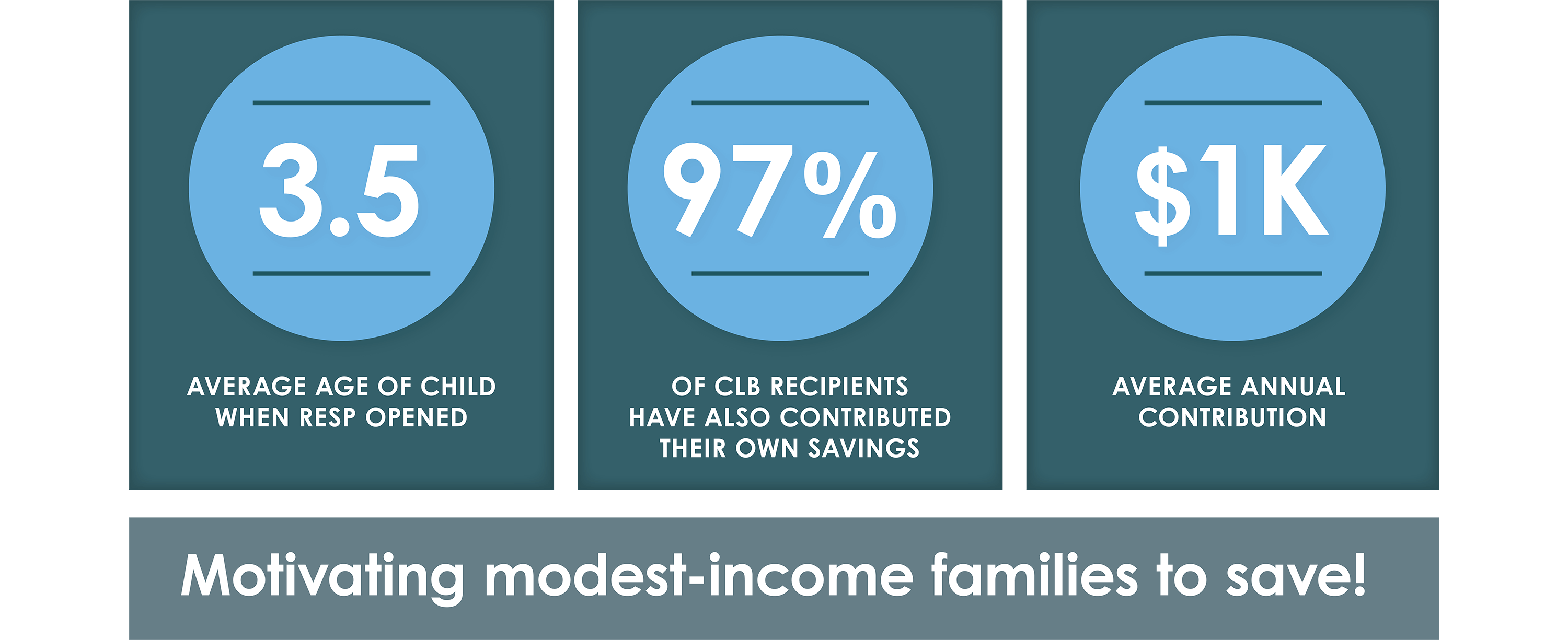

RSP + CLB

“For students from low-income families who do access post-secondary studies, the absence of family savings is offset in two ways: through greater reliance on government student loans and grants, and through greater reliance from income from employment, including employment during the school year. In this context, it is worth noting that research by the Government of Canada suggests that post-secondary students who are beneficiaries of an RESP are able to use their RESP funds to cover approximately 40 per cent of their education-related expenses (including tuition and living expenses) in the years in which they make a withdrawal (ESDC, 2015b, 26).”

Download the full research study (available via PDF)

Educational savings has a positive, life-long impact on children from modest-income households.