National impact

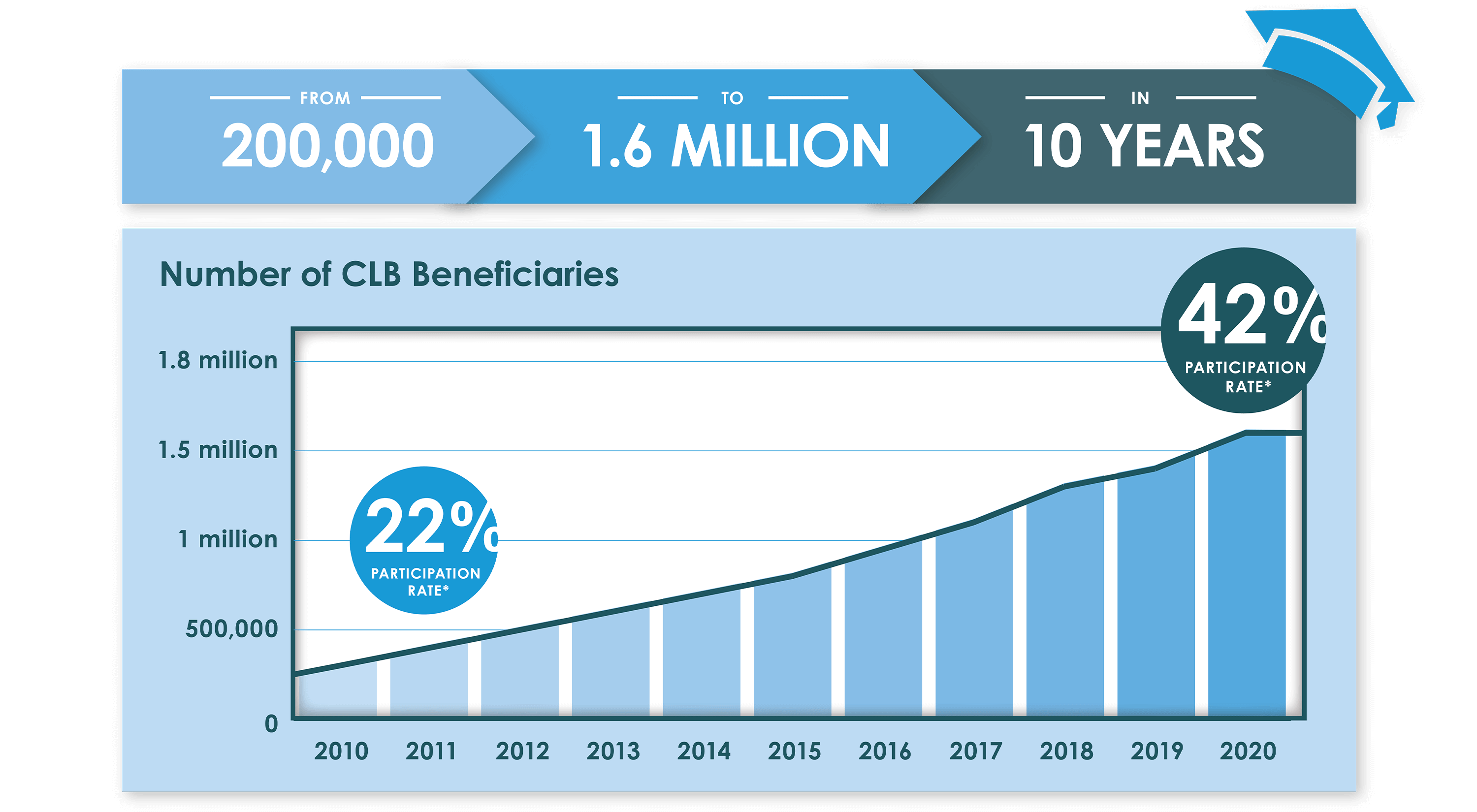

SmartSAVER, launched by the Omega Foundation in 2010, has been motivated from its inception by the belief that children from all families should be able to pursue a post-secondary education, regardless of household income or assets. We were convinced that the federal government's Canada Learning Bond (CLB) - $2000 in non-repayable funding for eligible children - had the potential to help a far greater number of families than it had traditionally reached. By 2010, national participation in the CLB program was stalled at 20%. By 2021, participation had increased to 40% thanks to SmartSAVER and our 80 community partners. This means 1.7 million children have been added to the roster of future high school students more likely to apply for, and attend, post-secondary education.

National Canada Learning Bond Beneficiaries

How did SmartSAVER achieve impact?

The barriers to participation in the Canada Learning Bond are complex, and so SmartSAVER and partners have, by necessity, addressed the challenge through multiple strategies:

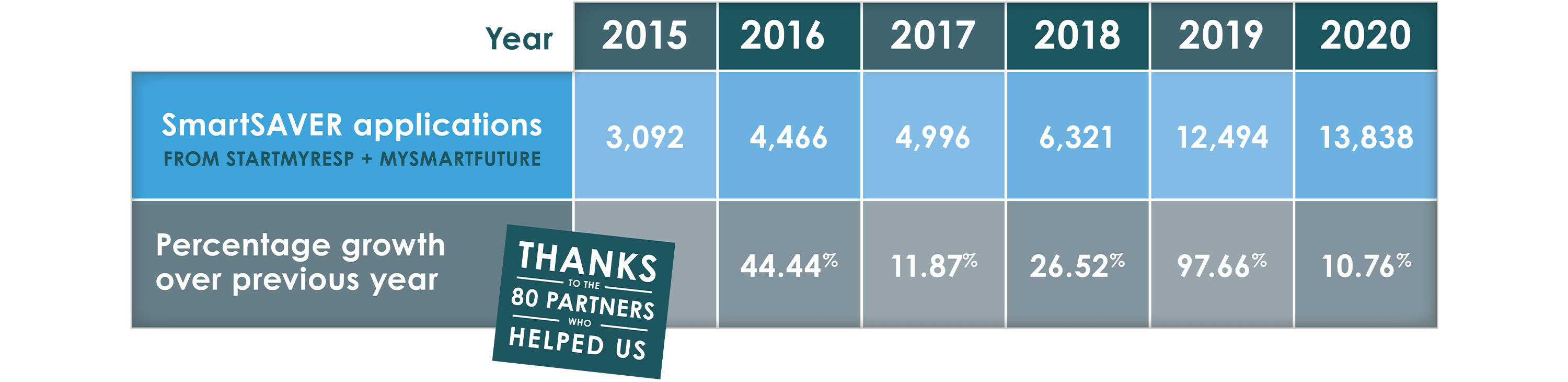

- Creating an online portal to make signing up for the CLB easy. The original SmartSAVER portal (now relaunched as MySmartFUTURE) helped over 55,000 children access the CLB between 2015 and mid-2021.) The sign-up rate is accelerating and so we anticipate even better results in the years ahead.

- Updating the digital pathway for families filing taxes with TurboTax and Ufile in order to improve access to the CLB. These process improvements had rapid results, with TurboTax applications to CLB increasing sevenfold over the previous year.

- Running pilot programs with three large community partners to test financial incentives for families. With Momentum in Calgary, New Circles Community Services in Thorncliffe Park, Toronto, and eight YWCA member associations, we analysed the success of incentives of up to $500 to eligible families signing up for the CLB.

- Partnering on tax clinics with federal and provincial governments. Through provincial mail-out campaigns and the Canada Revenue Agency's "Super Tax Clinics" we fostered greater awareness of the CLB among eligible families. In 2016 alone, there were over 100 community-based tax clinics that used SmartSAVER's tax-time tools so families could see the benefits they were entitled to and start their RESPs to be able to receive them.

- Engaging with First Nations has helped us understand how they can empower their communities to access the CLB. Critically, we have identified a lever for additional impact - an amendment to the Income Tax Act - and have made that a major focus of our ADVOCACY efforts.

National Canada Learning Bond Beneficiaries

SmartSAVER's work has been inspired and reinforced by a growing body of research showing that educational savings drive up post-secondary enrolment among children from modest-income families and can be the catalyst for greater achievement - i.e. higher graduation rates from high school and post-secondary institutions. We have conducted some of that research ourselves, as you can discover in the RESOURCES section.