A catalyst for change

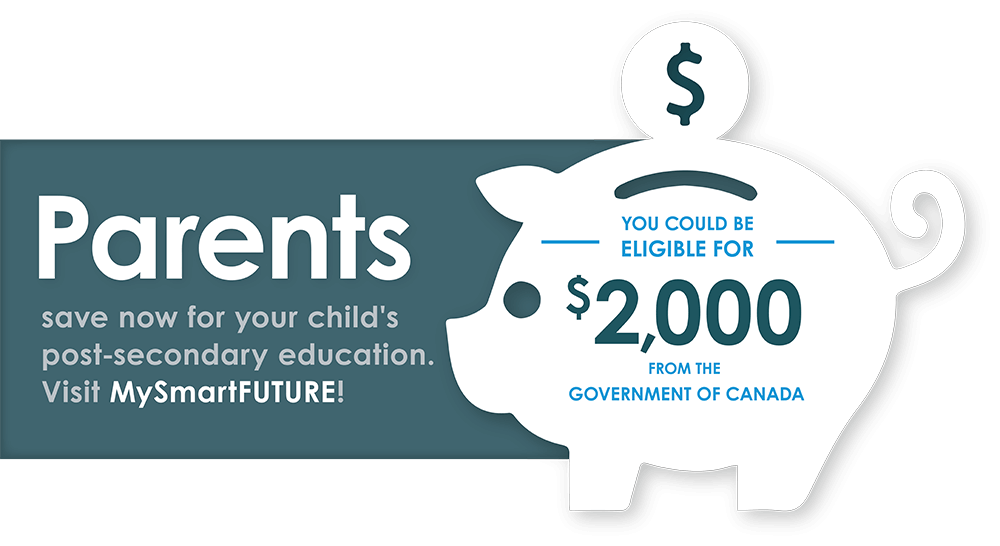

SmartSAVER, a program launched by the Omega Foundation, has worked for over 10 years to help Canadian families with modest incomes save for their children's post-secondary education. We have done this by increasing participation in the federal government's Canada Learning Bond (CLB).

ImpactLearn how we've helped drive up CLB participation from 20% to 40% - that's 1.7 million more families benefitting.

ImpactLearn how we've helped drive up CLB participation from 20% to 40% - that's 1.7 million more families benefitting.- ResourcesFind out how the CLB works, view our resources for families, or download our research reports.

- NewsUpdates on our advocacy, legislative changes, new partnerships, and testimonials from families.

- MySmartFUTUREDiscover why and how we redesigned the online portal that makes it easier than ever for families to start saving.